1. Chairman Oberman’s Stand Against Short-Term Activism in Railroads

At the Southeastern Association of Rail Shippers 2024 Spring Meeting, Martin J. Oberman, Chairman of the Surface Transportation Board (STB), addressed the conflict between Norfolk Southern (NS) and Ancora Holdings. His keynote underscored the critical balance between the pursuit of short-term financial gains and the long-term strategic planning vital for public safety and economic stability within the railroad industry. Oberman criticized Ancora’s attempts to restructure NS’s board and operational strategy, which he viewed as harmful to the rail service’s long-term viability and safety. He highlighted the adverse effects of such short-term strategies on workforce, service quality, and overall sustainability, emphasizing the importance of maintaining a focus on strategic growth and public responsibility.

Oberman’s stance illuminates the broader challenges facing the U.S. rail industry, where the push for immediate profits by activist investors threatens the foundational principles of rail service and public safety. He warned of the potential systemic impacts of such strategies, referencing the past service crises as cautionary examples of the ripple effects across the rail network. The speech was a call to action for regulatory vigilance and strategic resilience, highlighting the essential role of railroads in America’s industrial and economic fabric. As the conflict between NS and Ancora unfolds, it represents a pivotal moment for the industry, with implications for the future direction of freight railroading in the United States.

Above is our summary that captures the highlights in order to save you time, but you can read the full transcript of Chairman Oberman’s speech at the SEARS conference HERE.

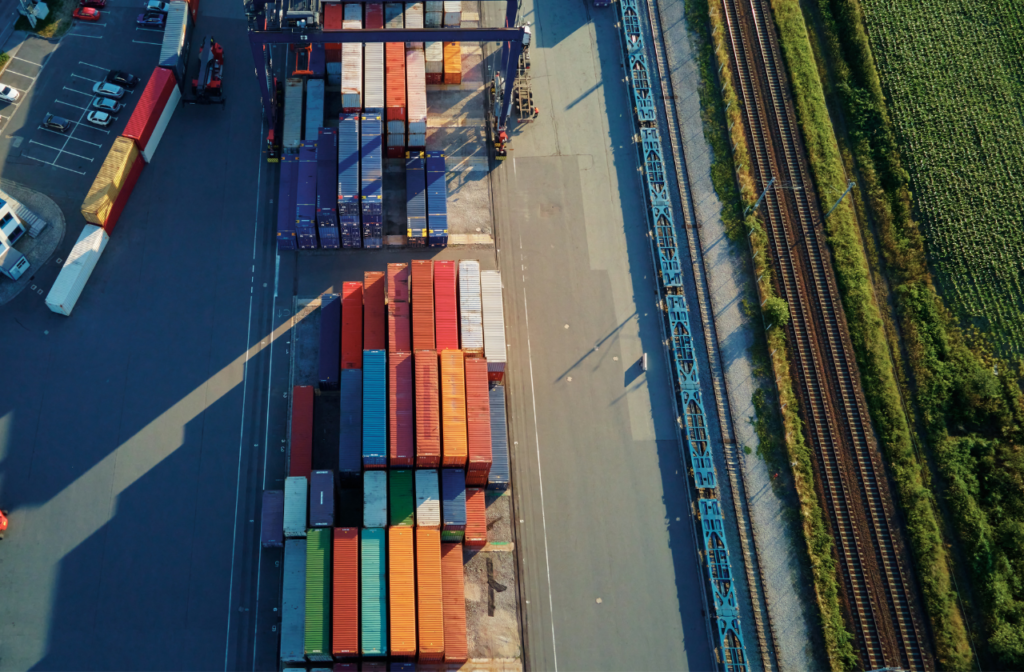

2. Analyzing the Rise in Logistics Rents: Prologis’ 2023 Insights

In 2023, the logistics sector saw rents rise by 6% globally, a significant yet stabilizing increase following a record 30% gain the previous year, as reported by Prologis in their Logistics Rent Index. This growth, spurred by persistent demand and low vacancy rates across North America, Europe, Asia, and Latin America, illustrates the sector’s resilience amid disruptions and the evolving need for supply chain adaptation. Particularly notable was Mexico, where rents surged by 19% due to nearshoring trends, low vacancies, and rising replacement costs, dramatically reducing the vacancy rate to about 1% in its main markets and boosting market rents significantly.

Looking ahead, the logistics real estate sector is expected to continue growing, though at a more moderate pace. Projections suggest that replacement costs, a significant factor behind rent increases, could stabilize, with potential shifts in construction costs and interest rates. Mexico, in particular, is poised for continued growth, driven by strong demand and strategic nearshoring benefits. This outlook underscores the importance of strategic planning and investment in navigating the logistics real estate sector’s evolving landscape, emphasizing the crucial role of understanding rent dynamics for businesses looking to optimize their operations and real estate strategies.

Above is our summary that captures the highlights in order to save you time, but you can read the full Prologis Logistics Rent Index report HERE.

3. The $1 Trillion Challenge: Electrifying America’s Trucking Industry

As the Biden administration embarks on ambitious plans to roll out electric vehicle (EV) infrastructure for medium- and heavy-duty vehicles by 2040, the trucking industry faces a monumental challenge. A study conducted by the Roland Berger Group for the Clean Freight Coalition (CFC) estimates the cost of this transition at an astonishing $1 trillion, highlighting a significant financial hurdle against the backdrop of the industry’s $830 billion revenue in 2022. This move towards electrification necessitates an estimated $620 billion investment from the commercial vehicle sector for charging infrastructure, with utilities needing an additional $370 billion to upgrade grid networks. These investments are crucial to accommodate the surge in demand for electric commercial vehicles, even as the cost of these new trucks remains substantially higher than traditional diesel models.

The report advocates for a cautious and phased approach to decarbonization, emphasizing the need for cross-industry cooperation and government support to manage the transition effectively. The potential for increased freight bills poses a significant concern for shippers, urging industry leaders and stakeholders to call for realistic, technology-neutral policies that can facilitate emissions reduction without compromising the supply chain. This analysis serves as a crucial reminder of the need for collaborative efforts to ensure a viable path toward a sustainable and economically feasible future for the trucking industry, avoiding undue financial strain on the broader economy.

Above is our brief summary of the key points to quickly bring you up to speed. For more in-depth information, you can read the full NMFTA article here. To delve deeper into the challenges and strategies outlined by the Clean Freight Coalition, explore the comprehensive report here, or check out the concise one-page summary here for a quicker read.

4. West Coast Ports Spearhead 2024’s Freight Momentum

Following a robust beginning to 2024, the Ports of Los Angeles (POLA) and Long Beach (POLB) have reported another month of strong performance in February, underscoring the vitality and resilience of the West Coast’s maritime logistics hub. POLA experienced a remarkable 60% annual gain in TEU volumes, marking the seventh consecutive month of year-over-year growth, driven by significant increases in imports, exports, and empty containers. The sustained growth, with POLA’s total volume up 35% annually in the first two months of 2024, reflects the port’s return to pre-pandemic levels. Similarly, POLB witnessed a 24.1% annual increase in total volume for February, with a notable rise in imports. These gains highlight the effective management and operational efficiencies at the ports, alongside robust consumer confidence and spending habits fueling the demand for imported goods.

As we navigate through the complexities of the global supply chain and maritime logistics, it’s crucial for businesses to have reliable and personalized freight forwarding and customs brokerage support. Whether optimizing your supply chain operations or navigating the intricacies of international trade regulations, our expertise ensures your cargo moves smoothly and efficiently. Partner with MTA today to capitalize on the opportunities presented by the thriving activity at POLA and POLB, and secure a competitive edge in your logistics and supply chain strategy.

Above is our summary that captures the highlights in order to save you time, but you can read the full updates from the Ports of Los Angeles and Long Beach: POLA Update, POLB Update.

5. Bridging the Preparedness Gap: Enhancing Supply Chain Resilience for SMEs

Small and mid-sized companies are currently facing a significant preparedness gap for potential supply chain disruptions, as highlighted by Dun & Bradstreet’s Global Business Optimism Insights. The report indicates that while business continuity and operational resilience are recognized as critical risks for 2024, it is predominantly larger businesses that are actively prioritizing the fortification of their supply chains. In contrast, smaller enterprises are more focused on expanding their customer bases, often overlooking the necessity to bolster their supply chains amidst growing complexities. This oversight places these businesses at risk of reputational damage and financial losses, underscoring the urgency for improved supplier communication, diversification of supply chains, and a more resilient supply chain model incorporating environmental, social, and governance (ESG) considerations.

Understanding and establishing strong relationships with suppliers emerge as fundamental steps toward enhancing supply chain resilience, as per Steve Yurko, CEO of apexanalytix. Such relationships not only facilitate better risk management and mitigation within the supply chain but also contribute to profitability by ensuring a deeper understanding and visibility across multiple tiers of the supply chain. However, the integration of advanced technologies like artificial intelligence (AI) is crucial in establishing these relationships, presenting a significant challenge for smaller companies with limited resources. As the landscape of global supply chains continues to evolve, businesses of all sizes must prioritize their supply chain resilience to navigate future disruptions successfully.

For companies looking to strengthen their supply chain and navigate these complexities with expertise, MTA offers personalized logistic services tailored to your business needs, ensuring robustness and efficiency in your supply chain operations. Contact MTA today to secure your supply chain against the unforeseen challenges of tomorrow.

Above is our summary that captures the highlights in order to save you time, but you can read the full Dun & Bradstreet Report and Supply Chain Management article.

Our Commitment

MTA is dedicated to navigating these complex challenges, leveraging our expertise and resources to maintain the reliability and efficiency of your logistics needs. We remain steadfast in our commitment to Delivering First-Class Solutions, ensuring the continuity and adaptability of your supply chain operations.

Conclusion

The insights from March 2024 highlight the intricate and dynamic nature of global logistics and supply chains. From the strategic importance of railroads and rising logistics rents to the electrification of the trucking industry and the imperative of supply chain resilience among SMEs, the landscape is rich with opportunities for innovation and growth. MTA’s commitment to delivering first-class solutions ensures that our clients are well-equipped to navigate these challenges, fostering a robust and responsive supply chain ecosystem that thrives amid change.