1. Navigating the Road Ahead: Study Reveals Key Goals for Shippers and Carriers in 2023

Breakthrough, a leading innovator in transportation management, has recently released its highly anticipated “2023 State of Transportation” study, shedding light on the top goals and challenges shippers and carriers face in the industry. The study reflects the mounting pressure on transportation leaders to reduce costs and emissions while adapting to macroeconomic challenges and shifting market priorities. With volatile fuel prices and capacity fluctuations among their main concerns, industry leaders are eager to recalibrate their strategies and leverage emerging opportunities for decarbonization, efficiency, and cost savings in the coming year.

Conducted by surveying 500 transportation leaders, including shippers and carriers, the study offers valuable insights into the current state of the transportation industry. It reveals that an overwhelming 94% of respondents agree that consumer demand for more sustainable products has elevated the priority of reducing emissions over the next 12 months. This recognition of sustainability as a critical focus is further supported by the fact that 99% of shippers express their willingness to embrace electric or alternative energy vehicles if carriers in their networks provide them. Carriers, on the other hand, see the value in adding electric vehicles (EVs) to their fleets, with 59% planning to take action by the end of 2023. These numbers highlight the industry’s collective commitment to embracing greener transportation solutions.

To achieve their goals, transportation teams are urged to leverage the right tools, data, and partnerships. The study reveals that transportation leaders feel prepared to address market uncertainty, with 97% indicating they have the right tools, 96% emphasizing the importance of partnerships, and 92% confirming they have the right staff in place. However, there is still room for improvement, with a third of respondents expressing the need to fine-tune operations in these areas. The study suggests that new tools and partnerships can greatly assist transportation teams in achieving their objectives and overcoming challenges in the next 12 months. Specifically, a more cost-effective fuel reimbursement strategy and increased visibility into their networks are seen as highly beneficial. This is where transportation data and technology partners play a crucial role in providing the necessary support.

Above is our summary that captures the highlights in order to save you time, but you can read the full report HERE

2. Unveiling the Bullwhip Effect: Risks and Caution Surrounding US Import Volumes

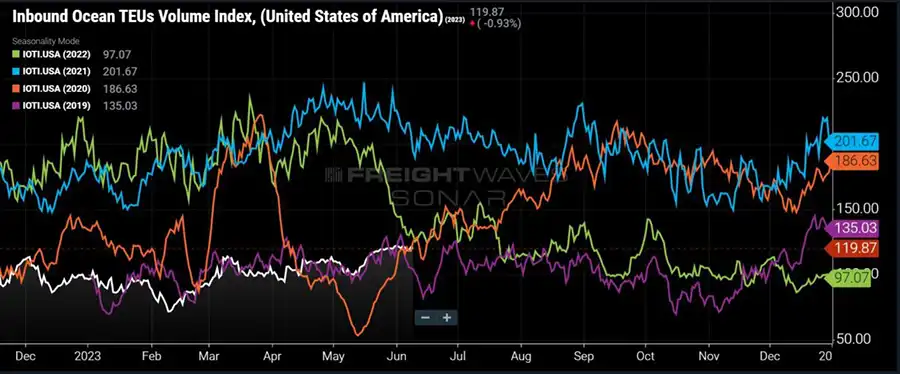

The “bullwhip effect” is making its presence felt in the containerized imports market in the United States, raising concerns about a potential decline in import volumes in the second half of 2023. This phenomenon refers to the amplification of demand fluctuations as they move through the supply chain, leading to increased volatility in inventory levels. Importers are approaching the peak season with caution, considering the lingering effects of the bullwhip effect and significant risks to consumer spending. With high inventory levels, a weakening global macroeconomic backdrop, and potential challenges in consumer demand, import volumes are at risk of experiencing a decline.

Container bookings have been closely aligned with 2019 levels thus far, but there are expectations of a detachment from this trend in early Q3. This would result in a notable drop of 10% to 20% below the import levels observed during the second half of 2019. The Logistics Managers’ Index (LMI) report for May indicates a contraction in overall inventory levels, although downstream retail inventories continue to grow while upstream manufacturer and wholesaler inventories contract. Importers must strategically manage their reordering efforts to avoid further inventory buildup and effectively navigate cost management. Major retailers like Target serve as examples of cautious approaches taken by importers to address excess inventories caused by the bullwhip effect and adapt to evolving consumer spending patterns.

In addition to the challenges posed by the bullwhip effect, importers must navigate the complexities of inventory management strategies. One such comparison is between “Just in Time” (JIT) and “Just in Case” (JIC) approaches. JIT emphasizes lean inventories and timely deliveries, minimizing the risk of excessive inventory accumulation. On the other hand, JIC involves holding higher inventory levels as a precautionary measure to address unforeseen demand fluctuations or supply disruptions. Understanding the nuances between these strategies is crucial for importers seeking to optimize their inventory management practices. For a more in-depth exploration of JIT and JIC, including their benefits and considerations, please refer to our recent article, Supply Chain Resilience and the Shift From ‘Just in Time’ to ‘Just in Case’ to gain valuable insights into selecting the most appropriate inventory management approach for their operations.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on FreightWaves

3. Reshaping Supply Chains: From Efficiency to Resiliency

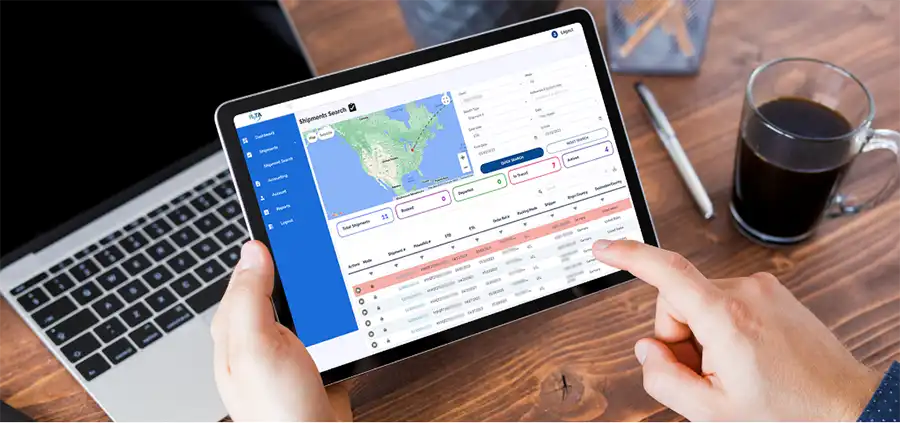

Pictured: MTA’s cutting-edge track and trace solution, My Track Assistant.

Companies are reevaluating their supply chain strategies in light of the lessons learned during the pandemic. Rana Foroohar, a global business columnist and economic analyst, highlighted the need to prioritize resiliency over efficiency in supply chains. The shift from “just-in-time” to “just-in-case” inventory levels is just one aspect of this transformation. Geopolitical risks and the higher costs associated with distant production are pushing companies to adopt a regional approach and reduce risk. The trend toward regionalization varies by industry and geography, but the overall goal is to create more transparent and resilient supply chains.

Additionally, digital technologies are playing a crucial role in transforming supply chains. Foroohar emphasized the need for logistics and manufacturing enterprises to leverage digital tools that other industries have already adopted. Big data, sensor technology, mobile applications, the Internet of Things, and additive manufacturing are set to revolutionize the supply chain industry.

As supply chain interruptions become more frequent, businesses are recognizing the importance of sourcing and moving goods with resiliency in mind. The new normal requires supply chains to be prepared for various disruptions, such as pandemics, geopolitical conflicts, and natural disasters. Companies are also increasingly focused on reducing financial, legal, regulatory, and reputational risks associated with their supply chains, including ethical and sustainable practices.

Discover the power of digital transformation and drive your supply chain efficiency with My Track Assistant. Enhance visibility, optimize operations, and navigate supply chain complexities with confidence. Unlock the full potential of your supply chain with MTA’s innovative solutions. Contact us today to explore how My Track Assistant can revolutionize your supply chain operations and empower your business for success.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on FreightWaves

4. Air Cargo’s Busy Season Looking More Like Molehill Than Mountain Peak: Industry Experts Discuss Current Market Realities

Companies reevaluate supply chain strategies amid a weakening market and shifting dynamics in the air cargo industry. As demand stabilizes after 16 months of a freight recession, extreme discounting by freight forwarders with excess committed capacity, coupled with the influx of passenger aircraft offering lower-deck storage, continues to push air cargo rates downward. While industry professionals remain optimistic about a potential revival in the fourth quarter, there is a growing realization that economic conditions and the peak season outlook are more uncertain than anticipated.

The decline in air cargo volume has slowed after an 8% drop in the previous year, but demand has not reached its bottom as the soft summer season begins and volumes remain below pre-pandemic levels. The International Air Transport Association (IATA) projects a 3.8% shrinkage in air cargo demand and a one-third retreat in airline cargo revenues year over year, attributing the decline to increased belly space from passenger flights and a slowdown in global trade. Despite the challenges, cargo revenues are expected to remain above pre-pandemic levels, driven by labor shortages, fuel expenses, and higher service charges.

As the industry faces a surplus of available aircraft and a reduction in shipments, the combination of increased supply and lower demand continues to exert downward pressure on air cargo rates. Market indicators reveal a closer alignment to 2019 levels, with pricing below the pre-pandemic period when accounting for fuel costs. However, the correlation between freighter flight hours and freight demand remains a determining factor. While some industry players expect a better peak season, caution prevails due to weak manufacturing, rising interest rates, inflation concerns, and the impact on consumer spending.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on FreightWaves

5. Back to the West Coast: Cargo Traffic Returns Amid Lower Rates and Renewed Confidence

Cargo owners are shifting their traffic back to the US west coast ports after concerns about potential lockdowns or congestion led to a diversion of volumes to ports on the East and Gulf coasts. The return to the west coast is driven by rising confidence that serious disruptions will not occur and cost pressures. Ports like Long Beach and Los Angeles, which experienced significant drops in container volumes, have seen a recent uptick in traffic. However, despite the return, there is an acknowledgment that some changes may be permanent as certain cargo owners have established distribution centers near ports on the east coast, positioning their inventory closer to the consumer.

While west coast ports processed 40% of US container imports in the first quarter of this year, down from 45% in 2019, the recent shift back to the west coast indicates a positive trend. The deployment of sufficient capacity by carriers has contributed to this change, and lower rates for shipping to the west coast are also prompting cargo owners to reconsider their routing options. However, it is important to note that some cargo volumes may remain on the east coast as importers strategically position their inventory near those ports. This shift highlights the evolving dynamics of the US container shipping landscape and the considerations that shape cargo owners’ routing decisions.

Ready to navigate the evolving logistics landscape and boost your supply chain efficiency?

Get in touch with us today and discover how our industry-leading solutions can help you overcome challenges, optimize operations, and stay ahead of the competition. Let’s embark on a journey to transform your logistics into a strategic advantage.

Above is our summary that captures the highlights in order to save you time, but you can read the full report on The Load Star