1. Intermodal Volumes Decline in Q1 2023: Insights from IANA’s Report

The Intermodal Association of North America (IANA) has released its Intermodal Quarterly Report for the first quarter of 2023, providing insights into the state of the intermodal industry. The report highlights a decline in intermodal volumes during the quarter, primarily attributed to low freight demand. Total intermodal volumes fell by 8.6% year-over-year, with all segments experiencing declines. Domestic container volumes dropped by 5.8%, international containers by 8.8%, and trailers by a significant 28.8%.

The report also points out that the seven highest-density trade corridors, responsible for handling more than 60% of the total volume, all experienced declines in the first quarter. The South Central-Southwest corridor saw the highest deficit at 19.2%, followed by the Southeast-Southwest at 16.0%. The Midwest-Southwest, Midwest-Northwest, and Northeast-Midwest corridors also saw declines ranging from 7.8% to 9.2%. However, the Trans-Canada corridor managed to hold its losses to just 1.2%.

Despite the challenging start to the year, IANA remains cautiously optimistic about the industry’s future. Joni Casey, President and CEO of IANA, stated that while falling consumer demand for goods and import declines have impacted intermodal volumes, improvements in network fluidity and equipment availability position the industry well for growth in the coming months. With the economy slowly recovering and conditions gradually improving, the intermodal sector is poised to bounce back and regain its momentum.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on Railway Age

2. Retail Sales Show Modest Growth in April Amidst Inflationary Challenges

Retail sales in April showed a modest increase of 0.4%, falling short of expectations, according to the Commerce Department. This growth, while positive, reflected higher prices rather than increased consumer demand. Excluding auto-related figures, sales also increased by 0.4%, in line with expectations. Miscellaneous store retailers experienced the largest gain, with a 2.4% increase, while online sales rose by 1.2% and health and personal care retailers saw a 0.9% rise. However, the overall picture indicates a struggling consumer base as gasoline sales dropped by 0.8%, and sporting goods, music, and bookstores posted a decline of 3.3%.

Despite the first positive reading since January, consumer fundamentals are turning less supportive, and the road ahead remains challenging. Higher inflation continues to pose significant obstacles for consumers, who have been accumulating higher debts to cope with rising borrowing costs for items like mortgages and credit cards. Total debt rose above $17 trillion in the first quarter, according to a report from the New York Federal Reserve. As the labor market cools and the impact of the Federal Reserve’s aggressive monetary tightening feeds through, a further slowdown is anticipated. Inflation remains a key concern, and the central bank is committed to returning inflation to its 2% target.

Overall, while the retail sales report showed some positive signs, it also revealed the underlying challenges faced by consumers. The economic landscape points to higher interest rates ahead, which could further impact consumer spending. As businesses and individuals navigate these obstacles, finding innovative solutions and strategies becomes crucial.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on CNBC

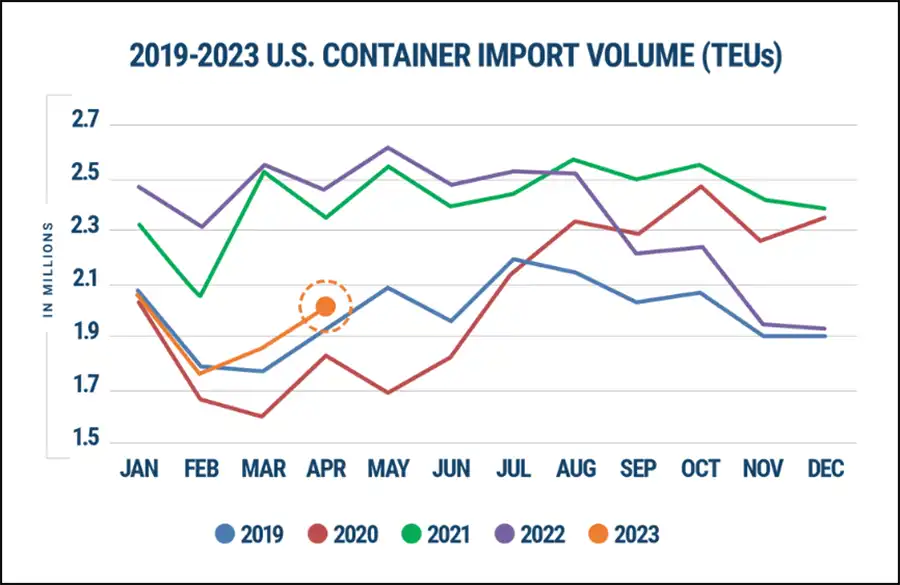

3. May Global Shipping Report by Descartes: Surge in U.S. Container Imports from China Reveals Growing Supply Chain Resilience

The Global Shipping Report reveals a significant increase in U.S. container import volumes during April 2023, driven by strong imports from China. Despite ongoing labor negotiations on the West Coast, delays at all ports have been reduced significantly, indicating improved efficiencies in the global supply chain. The report also highlights the consistency of import volumes with pre-pandemic levels seen in 2019. While progress is being made in the West Coast labor negotiations, the final contract remains unresolved. Nevertheless, the May update of logistics metrics suggests a positive outlook, with signs that several challenges to global supply chain performance in 2023 are diminishing.

In April 2023, U.S. container import volumes rose by a substantial margin, particularly due to increased imports from China. This growth demonstrates the recovery and resilience of international trade. Notably, delays at ports have significantly improved, enhancing the flow of goods across the supply chain. The ongoing labor negotiations on the West Coast show signs of progress, although a finalized contract is yet to be reached. The latest logistics metrics reveal a positive trend, aligning with pre-pandemic import volume seasonality and indicating an improving global supply chain performance in 2023.

Amidst the evolving dynamics of the global shipping industry, it is essential for businesses to stay informed about the ongoing disruptions and challenges. Discover the power of our innovative My Track Assistant that allows you to effortlessly monitor your shipments’ progress and streamline your logistics process. Stay ahead of emerging trends and embrace effective strategies to ensure the success of your shipping operations. Reach out to us today to explore how our expertise can support your shipping goals and help you overcome obstacles along the way.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on Descartes

4. Navigating the Challenges: The Transition to Zero-Emission Trucks in California’s Ports

California’s ambitious push for zero-emission vehicles in its ports and rail yards is presenting truckers with significant challenges as they find themselves on the front line of the state’s electrification efforts. The new regulation mandates that by 2024, all trucks used in the ports must be zero-emission vehicles, creating financial and logistical obstacles for trucking and shipping companies. While the transition to electric trucks aims to reduce pollution and improve air quality around the ports, many truckers are voicing concerns about the availability of charging infrastructure and the high costs associated with electric vehicles. The limited range of existing zero-emission heavy-duty trucks and the lack of public charging stations dedicated to medium- and heavy-duty trucks further compound the difficulties faced by the industry.

This regulation serves as a preview of the changes necessary not only within California but worldwide to combat climate change effectively. Environmental advocates argue that similar policies need to be adopted on a national and global scale. Although the transition to zero-emission trucks in California’s ports promises to accelerate the growth of the electric heavy truck industry and promote the development of charging infrastructure, trucking companies, particularly small businesses, are expressing concerns about the rapid pace of implementation. Some fear the potential financial strain and worry that they may be forced to shut down or relocate out of state. While the regulations aim to address environmental and public health concerns, stakeholders are advocating for a balanced approach that considers the readiness of the technology, charging infrastructure availability, and the financial feasibility of trucking companies.

Above is our summary that captures the highlights in order to save you time, but you can read the full article on WIRED

5. Breaking Barriers: Navigating Manufacturing Challenges for Thriving in a Dynamic Industry

The manufacturing sector continues to face challenges as indicated by the May Manufacturing Report on Business released by the Institute for Supply Management (ISM). The report reveals a seventh consecutive month of decline, with the May Manufacturing PMI® registering 46.9 percent, 0.2 percentage points lower than the 47.1 percent recorded in April. Despite these hurdles, there are signs of resilience and opportunities for growth in certain sectors. Sectors such as nonmetallic mineral products, furniture & related products, transportation equipment, and fabricated metal products are experiencing growth. However, other sectors like wood products, primary metals, apparel, leather & allied products, and more, are facing declines. Key metrics show a mixed picture, with slower contraction in new orders and production, a rebound in employment, and improvements in supplier deliveries. Nevertheless, manufacturers must embrace resilience and innovation to thrive in this ever-evolving industry.

To conquer the barriers ahead, the manufacturing industry needs to embrace a proactive approach. It’s time to foster innovation, streamline supply chains, and forge stronger collaborations with suppliers. By focusing on operational efficiency and nurturing a skilled workforce, manufacturers can position themselves for long-term success. Despite uncertainties that lie ahead, the industry has proven its resilience. With strategic planning and adaptability, manufacturers can not only weather the storm but also thrive in this ever-evolving business environment.

As a freight forwarder specializing in manufacturing logistics, we understand the unique challenges you face.

Contact us today to request a freight quote and discover how our tailored solutions can help streamline your supply chain and overcome obstacles in the manufacturing landscape.

Above is our summary that captures the highlights in order to save you time, but you can read the full report on ISM